-

Advantages:

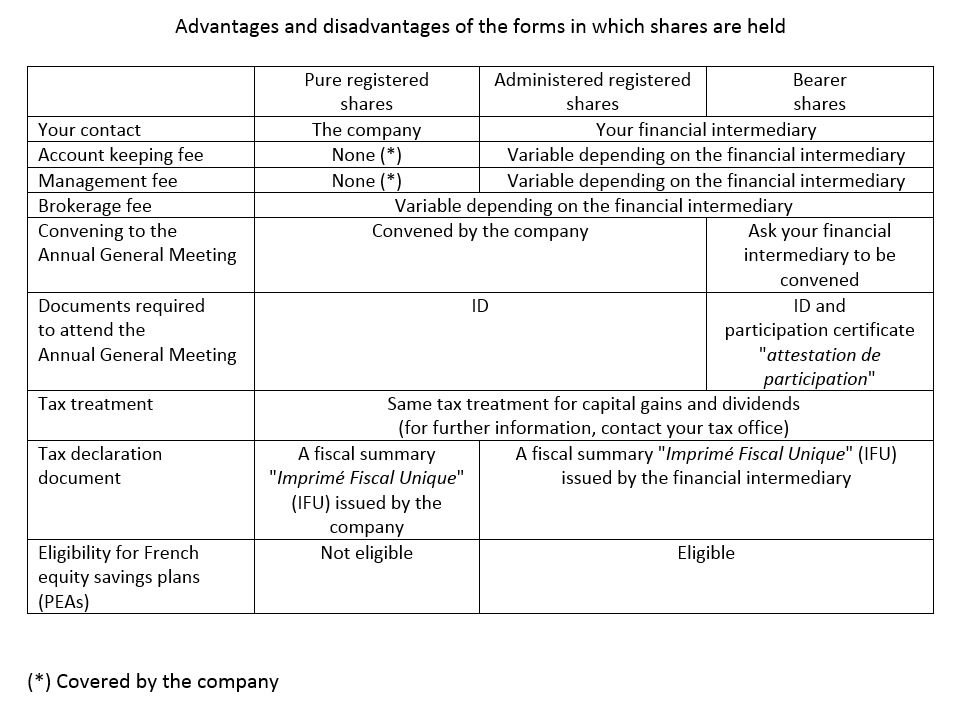

As shareholders’ identities are known, the company can send them information or notices of meeting directly.

They can attend shareholders’ meetings with no special formalities. Shareholders who hold Bouygues shares in registered form for more than two years have double voting rights.

Disadvantages:

To be sold, Bouygues shares must be in bearer form. Any sale of registered shares therefore requires that they first be converted into bearer shares and transferred to a financial intermediary.

Shareholders holding pure registered shares will receive as many statements and tax certificates as securities they own. The large number of documents thus accumulated can be inconvenient when completing tax returns. -

To convert Bouygues shares into pure registered form, the shareholder must transmit a request to the financial intermediary with whom the shares are deposited. When Bouygues receives the shares, it sends the shareholder notification and an account activation form.

Bouygues holds registered share accounts directly and is a member of Euroclear France as an issuer under No. 791. -

Managing pure registered share accounts within a PEA is complex and restrictive for both Bouygues, as depositary of the shares, and the financial intermediaries that hold the PEA securities and cash accounts. It is therefore Bouygues’ policy not to open such accounts.

Shareholders wishing to register their Bouygues shares already held in a PEA must choose the administered registered form. -

Bouygues has made it a general rule not to have any involvement in trades on behalf of its shareholders. Shareholders wishing to buy or sell Bouygues shares should therefore apply to the financial intermediary of their choice.

Before selling all or some of their Bouygues shares held in pure registered form, shareholders should send Bouygues a letter asking for them to be converted into bearer form with the financial intermediary of their choice, together with their bank account details (no charge is made for converting shares from registered into bearer form). Shareholders then transmit orders directly to their financial intermediary. -

To access the dedicated shareholder website, go to serviceactionnaires.bouygues.com

Access to our shareholder website is restricted to shareholders who own registered shares deposited with Bouygues (pure registered shares) or with a financial intermediary (administered shares). Access to this website is restricted to:

– Shareholders with full ownership of their shares

– Primary account-holders, in the case of a joint account [compte joint] or co-ownership account [compte en indivision]

– Primary account-holders who are bare owners in common [nus-propriétaires en indivision] in a split account [compte démembré]

– Secondary account-holders who are usufructuaries in a split account [compte démembré]

Offering a dedicated shareholder website is optional for companies, and Bouygues has decided to adopt this policy. -

All Bouygues shareholders are entitled to attend general meetings of shareholders, regardless of the number of shares they own.

To see the arrangements for participating in general meetings, go to this page. -

By telephone: 0 805 120 007 (toll free from fixed lines in France)

By e-mail: servicetitres.actionnaires@bouygues.com -

Shareholders can make their complaints to the Registered Share Service:

Via telephone: 0 805 120 007 (toll free from fixed lines in France)

Via e-mail: servicetitres.actionnaires@bouygues.com

The Registered Share Service acknowledges receipt of the complaint within ten business days of receiving it. An answer will be sent back within two months. If an answer cannot be sent back within this time period due to specific circumstances, the Registered Share Service will keep you informed.

If you do not receive an answer or you deem it unsatisfactory, you may contact l’Autorité des Marchés Financiers (AMF):

By post: Le Médiateur – Autorité des marchés financiers – 17, place de la Bourse – 75082 PARIS CEDEX 02

By using the Request for mediation form

Web site of the AMF Ombudsman -

The minutes and slides of each shareholders’ meeting are available on our website.

-

All Bouygues Universal Registration Documents and Annual Reports since 2001 are available on our website. You can either download them or order them by clicking here. You will then receive them by email.

-

For all financial information, please contact the investor relations team on +33 (0)1 44 20 11 01 or by e-mail: investors@bouygues. -

-

All the information regarding the Group’s financial results is available on the website:

Calendar

Press releases

Results presentations

Key figures -

A calendar is available on the website. It includes the dates and times at which financial press releases are issued. Click here to access the press releases.

-

Bouygues is included in the CAC 40 index. It is listed on Euronext Paris, Compartment A, eligible for deferred settlement (SRD).

-

ISIN Code FR0000120503